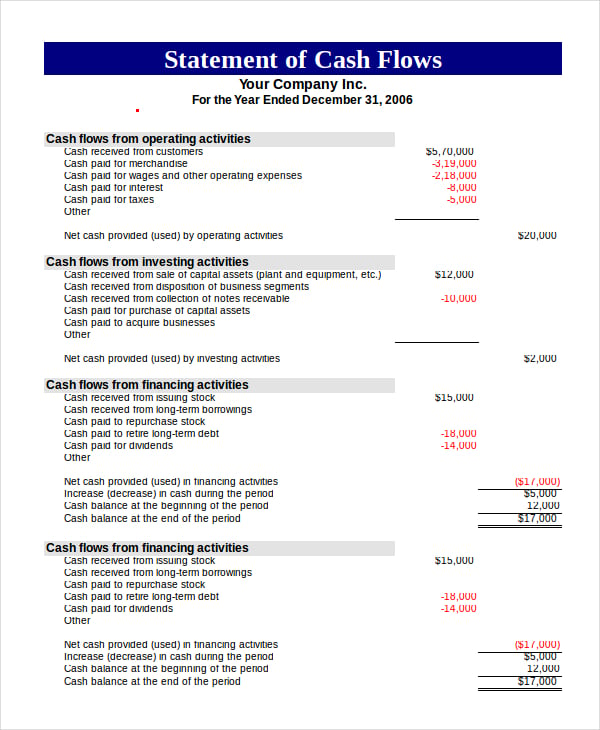

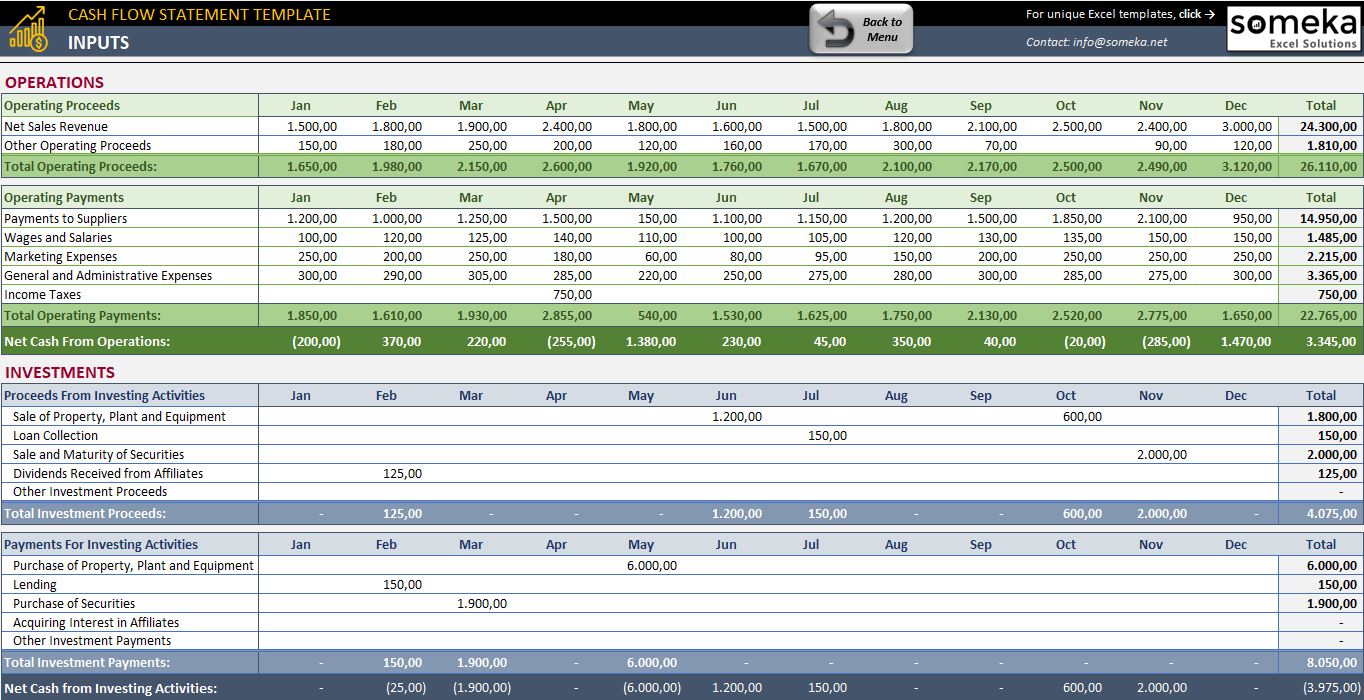

Many small businesses conduct their transactions exclusively in their native currency, and if that applies to your business, this line can simply be ignored. Note the line “Exchange difference on translation of foreign currency.” This field is used to display the result (source/use) of transactions done in currencies other than the business’s native currency. The fourth section reveals the change in the company’s cash position resulting from the activities detailed above. Loan proceeds are a source of funds, while payments are uses. You could also insert a line here that would account for financing or loan (i.e., borrowing/repayment) activity. The third section, Financing Activities, records the owner’s injections or withdrawals of cash. Proceeds or costs of purchase/sale activities of Property, Plant, and Equipment (PPE), Intangibles (patents as an example), or Investments (stocks or bonds as examples) are reflected here. The second, Investing Activities, shows the cash generated (or used) by business activities that may be occasional or more elective. This reflects the cash flow from the core of the business. The first, Operating Activities, reflects the cash generated (or used) by the business’s primary on-going activities. Note that the report comprises four sections. The first tab of the template is titled “Small Business Indirect.” This report is useful for analyzing the business’s cash flow when using your accrual-based balance sheet and profit and loss statements as your source of information for input. We’ll discuss each below and provide examples for their correct use. Let’s take a look at the template and what it provides.

It’s easy to set up, use, and understand. The template can be used for planning for future cash flows or for reporting the financial impact of your past business activities.

It also helps you to fully understand the impact that all your business processes have on your cash position. Using it, you, the business owner, can easily track your income, payments, and your business’s ending cash position. The Simple Cash Flow Statement For Small Businesses Template offers three excellent models for this purpose. A cash flow analysis tool is crucial for tracking incoming cash, cash outflows, and resulting cash balances.

However, understanding the business’s cash flow and its daily net cash position is often even more critical to the owner’s ability to manage the business effectively. Traditional financial statements – with categories of assets, liabilities, and profits and losses – are essential sources of information for small business owners.

0 kommentar(er)

0 kommentar(er)